Incentives were available for ductless heat pumps furnaces electric vehicle charging infrastructure solar energy systems and other energy efficiency devices.

Oregon residential energy tax credit 2018.

You can t be claimed as a dependent on someone else s return and.

From ductless heat pumps to rooftop solar to electric vehicle chargers your energy efficient improvements have made a big difference saving money saving energy and.

Your federal adjusted gross income isn t more than 100 000 if your filing status is single or married filing separately or isn t more than 200 000 for all others.

2017 residential energy tax credit rates residential energy tax credit rates are based on the statutory credit rates in ors 316 116 and are calculated based on the amount of energy saved.

Applications must be received by the oregon department of energy no later than june 1 2018.

Residential energy efficient property credit is available through 2021 and congress looks ready to extend some energy credits that expired in 2017.

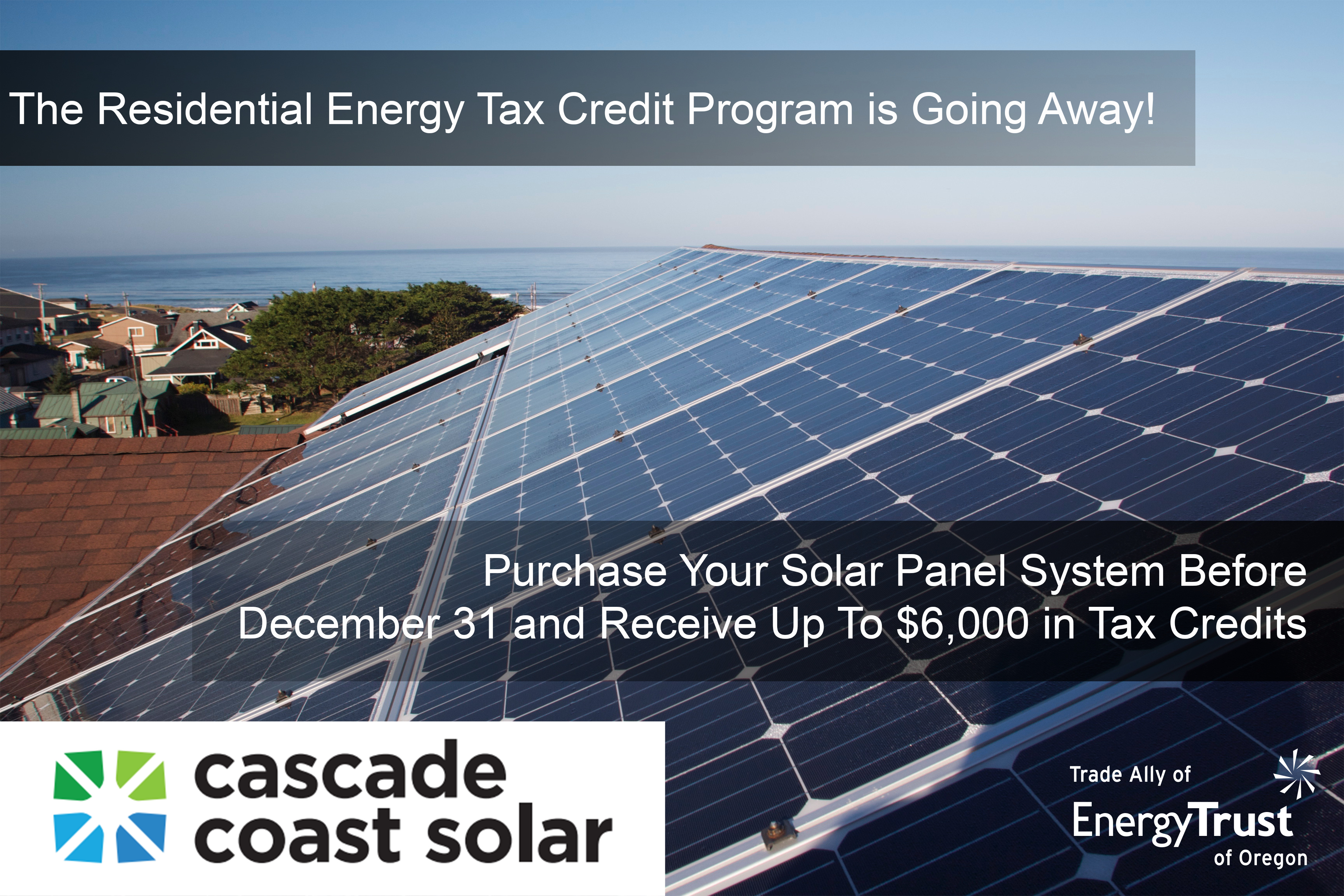

The retc program ended sunset on december 31 2017 and final applications were due june 1 2018.

The residential energy credits are.

To be eligible for a retc qualifying equipment or devices must be purchased by december 31 2017 and operational by april 1 2018.

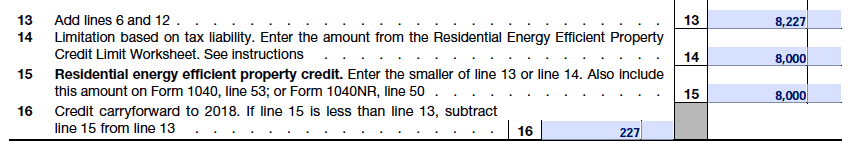

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

Credits oregon s personal exemption credit.

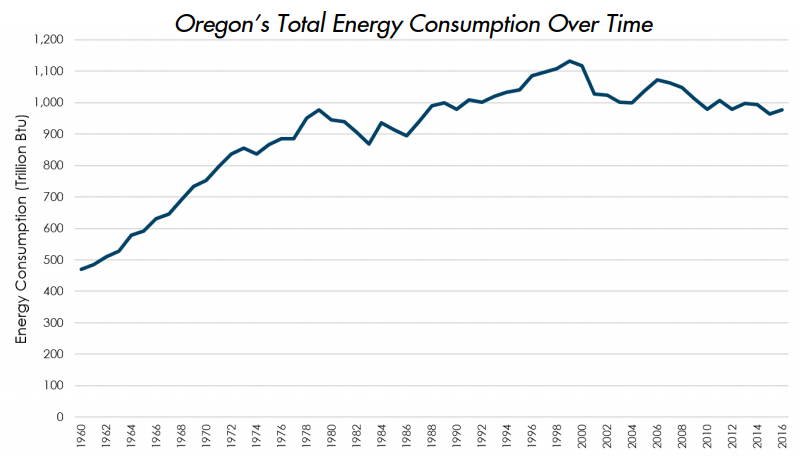

The oregon department of energy issued residential energy tax credits to oregonians between 1977 and 2017.

Unless stated otherwise tax credits listed below are up to 50 percent of the cost of the device or 1 500 whichever is less on any one application.

Energy in oregon odoe incentives saving energy cliff april 13 2018 retc taxes comment.

The program issues rebates for solar electric systems and paired solar and solar storage systems for residential customers and low income service providers in oregon.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

Oregon personal income tax.

The oregon department of energy s residential energy tax credit program ended in 2017.

This credit is available to you if.

The residential energy tax credit is a state tax credit and is only applied to your oregon personal tax liability.

Incentives were available for ductless heat pumps furnaces electric vehicle charging infrastructure solar energy systems and other energy efficiency devices.

The oregon department of energy issued residential energy tax credits to oregonians between 1977 and 2017.

So if you re thinking about installing solar power a solar water heater a geothermal unit or fuel cells now is probably a good time to act.

.jpg)